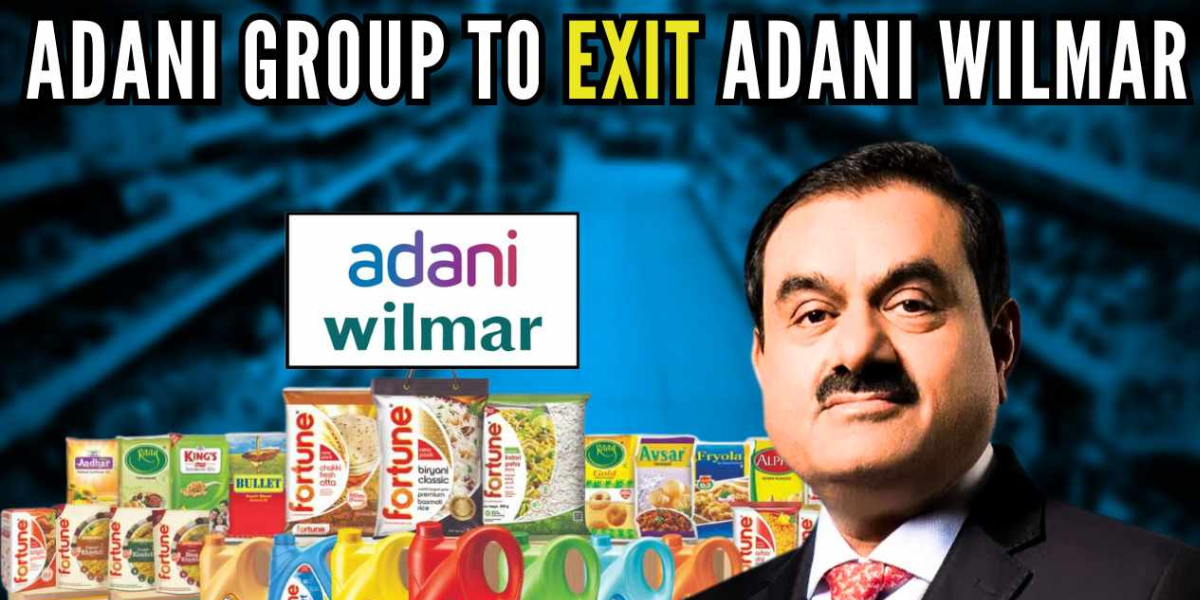

Adani Enterprises (AEL), Adani Commodities LLP (ACL, a

wholly-owned subsidiary of AEL) and Lence Pte (Lence, a wholly owned subsidiary

of Wilmar International (Wilmar)) have entered into an agreement on December

30, 2024, wherein Lence will acquire all the paid-up equity shares of Adani

Wilmar (AWL) held by ACL as at the date of exercise of the call option or put

option, as the case maybe, in respect of a maximum of 31.06% of the existing

paid up equity share capital of AWL.

In addition, AEL will divest around 13% shares in Adani

Wilmar to achieve compliance with minimum public shareholding requirements.

With completion of these two legs, AEL would completely exit its around 44%

holding in Adani Wilmar. As on December 27, 2024, Adani Wilmar had market

capitalization of Rs 42,785 crore ($5.0 billion).

In consideration of the above, AEL’s board of directors has

adopted a resolution noting the resignation of ACL’s nominee directors from the

board of Adani Wilmar. The parties have agreed to take further steps for change

of name of ‘Adani Wilmar’.

AEL will use the proceeds from the sale to turbocharge its investments in the core infrastructure platforms in energy & utility, transport & logistics and other adjacencies in primary industry. AEL will continue to invest in infrastructure sectors which will further strengthen AEL’s position as India’s largest listed incubator of platforms playing the key macro themes underpinning India’s growth story.

Source: Ace Equity